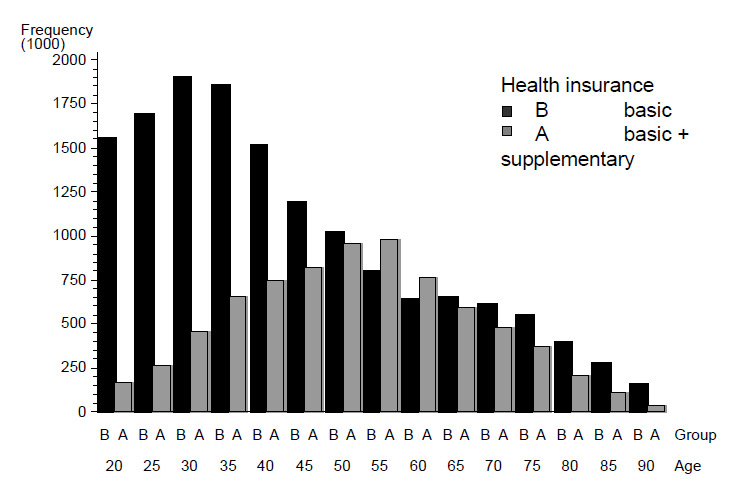

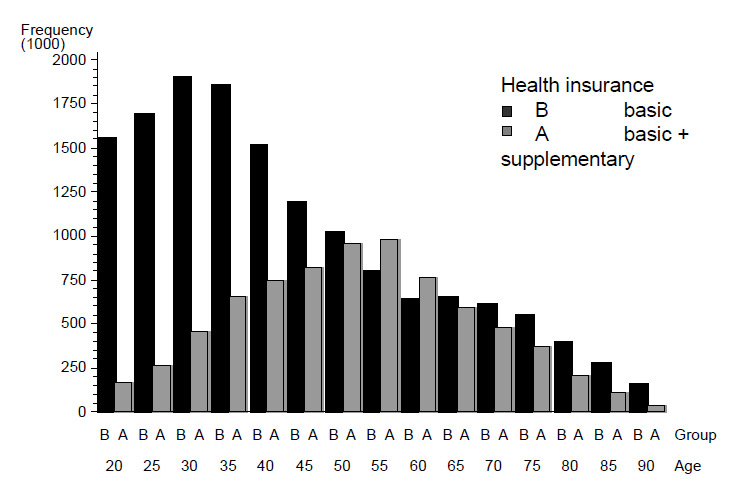

Figure 1

Age distribution of populations with basic or with basic plus supplementary health insurance for 2002–2005.

DOI: https://doi.org/10.4414/smw.2011.13152

Previous work has shown wide regional variations for major orthopaedic surgical procedures in Switzerland [1], and the available data, along with other observations [2], suggest that variation in use of resources is associated with redundancy and inefficiency. Potential sources of unwarranted variation include various supply and demand side effects and the extent of health insurance cover. Other economic factors [3–5] may also be relevant components of variance in this context.

All Swiss residents must purchase basic health insurance on an individual basis. Mandatory health insurance provided by authorised and competing insurance companies covers a standardised basic benefit package that includes a wide range of health services. Contracts may differ in terms of deductibles and premiums. However, by law there is open enrolment, premiums must be identical for all risk groups for a given deductible, and insurers are not allowed to make profits. Insurance companies can also offer supplementary insurance separately from basic health insurance [6]. Premiums and eligibility for supplementary coverage are conditional on risk status, there is no obligation to enroll and insurers can make profits in this market segment. Such additional products cover better levels of accommodation, more choice of physicians in hospitals and guaranteed access to almost all private and public hospitals in Switzerland. Our data show that some 25% of all insured take up supplementary coverage.

OECD data indicate [7] that type of health insurance can provide alternative sources of health financing and a way to increase system capacity; but private health insurance can also challenge the equity of health systems and can add to health care expenditures. With respect to specialist visits for example, there is evidence for a pro-affluence inequity [8] as supplementary insurance is often purchased by high income populations [7]. Taking into account the fact that most inpatient orthopaedic surgical procedures are performed by specialists with their own practices (but also working as affiliated physicians in hospitals), there may be a positive association between supplementary insurance and frequency of hospital admission for orthopaedic surgery in Switzerland. However, little empirical evidence is currently available on the direction and extent of such effects, and this study is therefore aimed at the following hypothesis: the type of health insurance is associated with different probabilities of surgery for musculoskeletal diseases in the Swiss population.

This study is part of larger project initiated and funded by the Swiss National Science Foundation (National Research Programme NRP 53) and methods of data collection and formation of utilisation-based health service areas (HSA) are described in earlier publications [1, 9] .

Figure 1

Age distribution of populations with basic or with basic plus supplementary health insurance for 2002–2005.

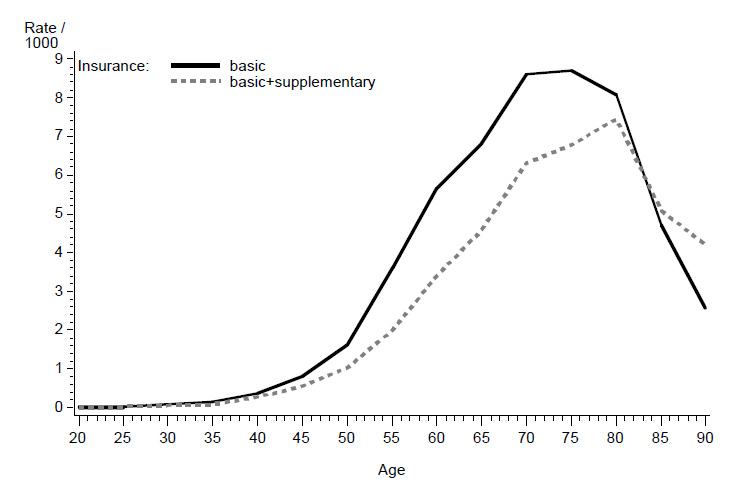

Figure 2

Incidence of total hip replacements in populations with basic or with basic plus supplementary health insurance.

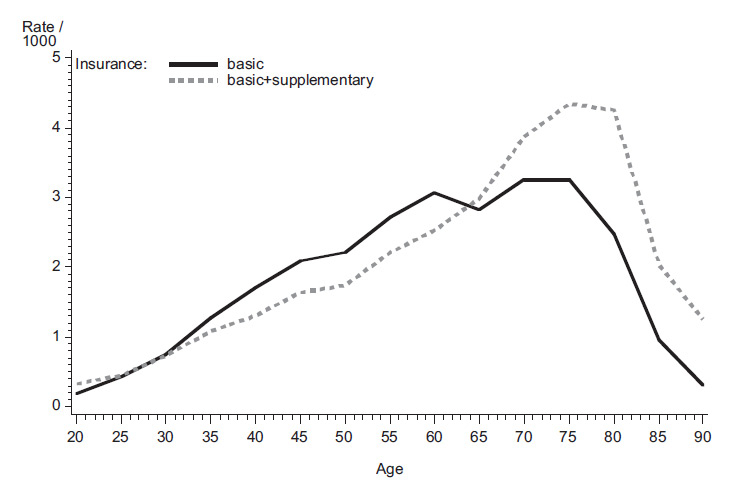

Figure 3

Incidence of in spinal surgery in populations with basic or basic plus supplementary health insurance.

Population-based information on type of health insurance was obtained from ten major health insurers (Avanex, CSS, Helsana, KPT, Progres, Sanitas, Sansan, Swica, Wincare, Visana). Insurance data was obtained at the level of health service areas, categorised by gender and twenty five-year age groups. The regional distributions of populations with basic or basic plus supplementary coverage were calculated using census data of the Swiss Federal Statistical Office (SFSO) for the period 2002–2005. Data of health insurers available for this study accounted for 66.8% of the overall Swiss health insurance market and on the basis of these data the number of individuals within each of the two insurance classes was extrapolated for each age and gender stratum within 83 health service areas [1]. The validity of this approach was confirmed by comparing these proportions nationally with information available from the Federal Office of Public Health [10], and differences between the study and the federal data for the percentage of the population with supplementary insurance ranged from –0.62% to 0.03% depending on the year. The insurance data of ten health insurers at the population level indicated an average share of 66.8% (median 71.5%) of the overall Swiss market. However, regional variation was obvious and market shares varied from 23.0% to 99.3% across HSA’s.

The complete dataset of discharges from hospitalisations for orthopaedic procedures performed in the years 2002 to 2005 was extracted from the Swiss hospital discharge master file of the Swiss Federal Statistical Office (SFSO). Based on ICD10 and procedure codes, the following orthopaedic procedures were selected for the study: total hip arthroplasty, total knee arthroplasty, hip fracture repair, shoulder arthroplasty, knee and shoulder arthroscopy and spinal surgery including decompression procedures for spinal stenosis and procedures requiring spinal fusion [1] . The comorbidity status of patients was assessed by calculating the Charlson index [11] using ICD10 codes of secondary diagnoses recorded in the discharge data. Inclusion criteria for all patients were a minimum age of 20 years, residence in Switzerland and at least one overnight stay in a hospital. Insurance and census data were linked with discharge records by hospital service areas, gender and age groups, and the resultant dataset provided the basis for the statistical analysis. Discharge records also included a variable describing insurance type of patients (basic, basic plus supplementary) and incidence rates of the above listed surgical procedures, and for both types insurance cover could be calculated for the period of 2002–2005.

Additional information on sociodemographic characteristics and health status of populations with either basic or basic plus supplementary health insurance was obtained from the 2007 Swiss Health Survey of the Swiss Federal Statistical Office [12]. This survey is performed every five years and provides representative data on the physical, mental and social wellbeing of the Swiss population, on resource utilisation, behavioural aspects and insurance cover in Swiss health care. However, these data could not be linked with the discharge/census dataset and the health survey data were used only for an informal interpretation of our results.

Effects of insurance class on the incidence of orthopaedic surgery were calculated using logistic regression. Specific models for each surgical procedure were tested at the level of an individual inhabitant and models had the following structure:

logit(Y=1|x) = β0 + β1 insurance class + β2 year + β3 age group + β4 sex + β5 HSA

The decision to include HSA’s as a geographical representation of populations was based on earlier observations showing considerable geographical variation in the use of in-patient resources for musculoskeletal problems in Switzerland [1, 13] . The parameter estimate for type of insurance (β1) was interpreted as a relative risk estimate (odds ratio, OR) with basic health insurance as the reference level. Preliminary analyses indicated significant age x insurance-class interactions, and therefore an additional analysis, stratified by three age groups: <50, 50–70 and >70 (40%, 29% and 31% of all cases, respectively) was performed. The stratified models had the same structure as the main models. A weighting variable was used to denote the number of individuals within each stratum and the number of observations for each model was 22.5 million, representing the total person-years at risk for 2002–2005 (Swiss population ≥20 years for four years). Population attributable risk percents (PAR%) for type of insurance were calculated. PAR% reflects the percent of the incidence of a disease in a population that is due to exposure. PAR% were calculated according to Rothman & Greenland [14] on the basis of the proportion of the population with supplementary coverage (proportion of "exposed") and by using adjusted risk ratios obtained by logistic regression. SAS 9.2 was used for all calculations (proc logistic; SAS Institute Inc., Cary, NC, USA.) and the significance level was set at p <0.05 throughout the study.

The proportion of the population covered only by basic health insurance increased from 70.4% in 2002 to 73.5% in 2005 (table 1) and the proportion with supplementary insurance was higher for women. There was age-dependent variation in the distribution of the two levels of insurance cover (fig. 1). Below the age of 45 and above 65 more than 50% of the population was covered solely by basic health insurance. Average cover by supplementary insurance was highest between 50 and 60. On average the population with supplementary insurance was considerably older than the population with basic health insurance (table 1).

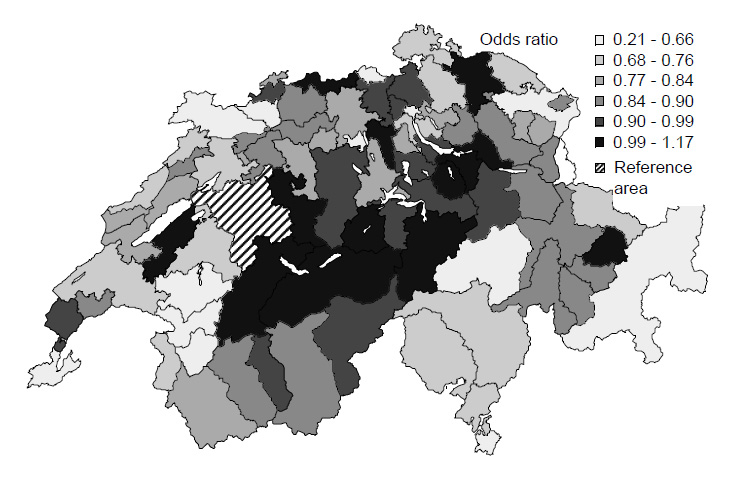

Figure 4

Odds ratios of health service areas for total hip replacements (2005).

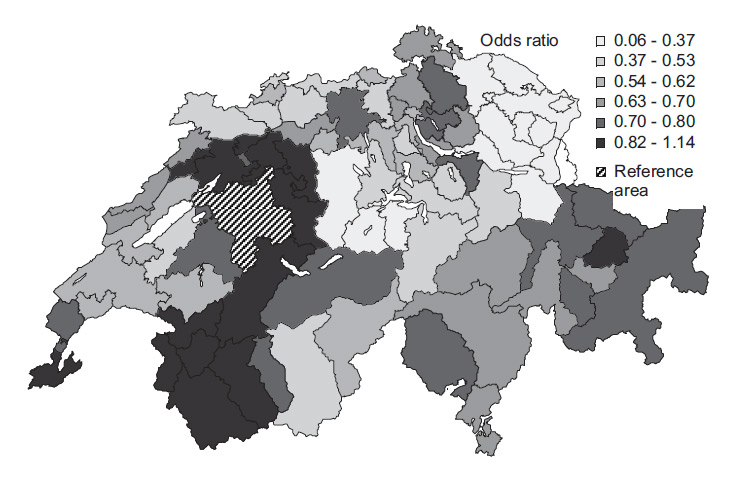

Figure 5

Odds ratios of health service areas for spinal surgery (2005).

Basic demographic structure and type of surgery for the two insurance classes are given in table 2. The data indicate similar demographics for patients with joint replacements and hip fracture repair, but patients for spinal surgery with supplementary coverage were on average 6.1 years older than patients with only basic insurance, and the proportion of female patients was also considerably higher in this population. Patients with basic health insurance consistently had the most severe status of co-morbid conditions as assessed by the Charlson index (table 2).

Table 3 provides an overview of the observed annual incidence of major orthopaedic surgery during 2002–2005 for insurance class across three age groups. The data show not only increasing rates over time (except for hip fracture repair) but also considerable differences between age groups and type of cover. As examples, differences are visualised for total hip replacements (fig. 2) and spinal surgery (fig. 3).

Age- and gender-adjusted odds ratio estimates of probabilities for orthopaedic surgery, irrespective of age group, indicate almost equal risks of surgery between the two classes of insurance cover (OR = 0.99, table 4). There were, however, indication-specific differences. Odds ratios for joint replacements and for hip fracture repair reflect the overall pattern of lower surgery risks in the population with additional cover, and a particular “protective effect” is evident for hip fracture repair (OR = 0.60). PAR% range from –15.6% to –3.6% of lower incidence accounted for by class of insurance. Odds ratios for shoulder and knee arthroscopy indicate that the population with supplementary cover is 1.3 and 1.6 times more likely to undergo these procedures than the population with only basic cover, and PAR% of 9.7% and 17.2% document the respective risk excesses. Less consistent differences were observed for spinal surgery. The overall pattern for all spinal procedures (decompression or fusion) indicates higher risks of surgery in the population with supplementary cover, but decompression procedures are less likely in this population (table 4). Particularly higher probabilities of surgery are seen for spinal fusion (OR = 1.3; PAR% = 10.5%).

Odds of surgery were significantly associated with age, and indicate that the probabilities of undergoing surgery grow for each five year increment of age by a range of 1.08–1.88, depending on indication. Significant but inconsistent patterns across procedures were seen for effects of gender (table 4) and effects of time in terms of year of surgery were also statistically significant for almost all procedures with the exception of hip fracture repair, and indicate that odds of surgery increased consistently from 2002 to 2005. Health service area was significantly associated with the probability of surgery for all procedures analysed in this study. As an illustration of regional disparities, odds ratios for health service areas are given for total hip replacements and spinal surgery in figure 4 and figure 5. The region with the largest population count was used as the reference, i.e. the service area of hospitals located in the agglomeration of Bern.

The analysis stratified by age groups shows inconsistent effects of coverage class across age groups for some procedures (table 5). Particularly high probabilities of surgery were observed in the population with supplementary cover for knee and shoulder arthroscopies below the age of 50, and for spine surgery above 70 (fig. 3). In contrast, differences between groups for total hip replacement and hip fracture repair remained constant across age groups. However, population-attributable risk percents point to a considerable impact of type of health insurance on surgery risks in the age group of 50–70, where the proportion with supplementary cover is highest (table 5).

The 2007 Swiss health survey provided 17 271 records of respondents with complete information on class of health insurance [15]. The comparison between populations with basic and with basic plus supplementary health insurance indicate better self-perceived general health, less work-related musculoskeletal problems and considerably higher levels of education and income in the group with supplementary insurance (table 1). Levels of physical activity were equal among groups. But work-related physical activity was more prominent in the group with only basic insurance cover. Self-reported use of ambulatory and in-patient care was equal between groups. Body mass index was lower in the group with supplementary cover.

| Table 1: Sociodemographic characteristics of the Swiss population classified by class of insurance (2002–2005). | |||

| Basic | Basic+ supplementary | ||

| Population | |||

| Age (Years, mean) | 35 | 51 | |

| Proportion of female (%) | 49 | 56 | |

| Proportion of insurance class (%) by year | 2002 | 70 | 30 |

| 2003 | 71 | 29 | |

| 2004 | 72 | 28 | |

| 2005 | 74 | 26 | |

| 2007 Health survey Federal Statistical Officea | |||

| Proportion with university/college degree (%) | 11 | 26 | |

| Proportion of high/medium management job position (%) | 26 | 43 | |

| Average household income in Swiss francsb | 3736 | 5245 | |

| Proportion with "health oriented" lifestyle (%) | 91 | 93 | |

| # weekdays with physical activity (sport) b | 1.73 | 1.90 | |

| # weekdays with job related physical activityb | 1.86 | 1.50 | |

| Proportion with BMI >25 (%) | 53 | 45 | |

| Proportion in very good or good health (%) | 67 | 76 | |

| Number of doctor visits last 12 monthsb | 5.44 | 4.93 | |

| a 17 271 records of respondents with complete information on type of health insurance b Adjusted for age and gender | |||

| Table 2: Demographic structure of patients with major orthopaedic interventions across type of health insurance for 2003–2005 (age ≥20). | ||||||||

| Basic health insurance only | Basic and supplementary insurance | |||||||

| N | Age | % female | Charlson index | N | Age | % female | Charlson index | |

| Joint replacements | 50291 | 69.20 | 58.91 | 0.26 | 28873 | 68.57 | 60.37 | 0.16 |

| Spinal surgery | 23420 | 54.26 | 48.75 | 0.18 | 15693 | 60.37 | 55.85 | 0.12 |

| Hip fractures | 18958 | 81.77 | 77.7 | 0.71 | 5814 | 79.55 | 75.52 | 0.57 |

| Total orthopaedic surgery | 228670 | 61.58 | 59.24 | 0.24 | 147897 | 60.97 | 60.67 | 0.13 |

| Table 3: Annual incidence rates per 1000 inhabitants of major orthopaedic interventions across class of health insurance and age groups (age ≥20). | |||||||||||||

| Year | 2002 | 2003 | 2004 | 2005 | |||||||||

| Age group | 20–49 | 50–70 | >70 | 20–49 | 50–70 | >70 | 20–49 | 50–70 | >70 | 20–49 | 50–70 | >70 | |

| Intervention | Insurance class | ||||||||||||

| Joint | Basic | 0.23 | 5.74 | 11.93 | 0.25 | 6.27 | 12.86 | 0.27 | 6.84 | 14.13 | 0.27 | 7.15 | 15.51 |

| replacements | Basic+supplementary | 0.29 | 3.39 | 10.43 | 0.32 | 3.98 | 11.44 | 0.38 | 4.30 | 13.04 | 0.38 | 4.52 | 13.16 |

| Spine | Basic | 0.93 | 2.31 | 2.01 | 1.07 | 2.81 | 2.69 | 1.04 | 2.70 | 2.72 | 1.03 | 2.76 | 2.79 |

| surgery | Basic+supplementary | 1.02 | 1.95 | 2.86 | 1.19 | 2.31 | 4.05 | 1.11 | 2.34 | 3.91 | 1.24 | 2.56 | 4.47 |

| Hip fractures | Basic | 0.03 | 0.57 | 8.25 | 0.03 | 0.58 | 8.64 | 0.03 | 0.51 | 8.42 | 0.02 | 0.51 | 8.46 |

| Basic+supplementary | 0.03 | 0.23 | 3.89 | 0.04 | 0.21 | 4.07 | 0.03 | 0.25 | 4.24 | 0.02 | 0.27 | 4.19 | |

| Total | Basic | 5.09 | 24.12 | 38.94 | 5.71 | 26.31 | 42.66 | 5.75 | 28.32 | 44.94 | 5.62 | 28.79 | 47.88 |

| orthopaedic | Basic+supplementary | 8.47 | 18.93 | 32.52 | 9.40 | 21.08 | 36.16 | 10.12 | 23.51 | 39.57 | 10.42 | 24.59 | 41.37 |

| Table 4: Effect estimates for major orthopaedic interventions. | |||||

| Intervention | Insurance class | Age group | Female vs. male | Year | |

| OR | PAR%b | OR | OR | OR | |

| Joint surgery | |||||

| Total joint replacements | 0.898 (<.0001)a | –3.6 | 1.386 (<.0001) | 1.030 (<.0001) | 1.089 (<.0001) |

| Total hip arthroplasty (THA) | 0.885 (<.0001) | –4.0 | 1.371 (<.0001) | 0.797 (<.0001) | 1.071 (<.0001) |

| Total knee arthroplasty (TKA) | 0.922 (<.0001) | –2.7 | 1.404 (<.0001) | 1.510 (<.0001) | 1.115 (<.0001) |

| Total shoulder arthroplasty (TSA) | 0.989 (0.821) | –0.4 | 1.430 (<.0001) | 1.873 (<.0001) | 1.127 (<.0001) |

| Surgery for hip fractures | 0.602 (<.0001) | –15.6 | 1.875 (<.0001) | 1.820 (<.0001) | 1.008 (0.172) |

| Knee arthroscopy (KA) | 1.615 (<.0001) | 17.2 | 1.083 (<.0001) | 1.015 (0.092) | 1.089 (<.0001) |

| Shoulder arthroscopy (SA) | 1.317 (<.0001) | 9.7 | 1.098 (<.0001) | 0.874 (<.0001) | 1.153 (<.0001) |

| Spinal surgery | |||||

| Spinal surgery (decompression or fusion) | 1.080 (<.0001) | 2.6 | 1.142 (<.0001) | 0.904 (<.0001) | 1.067 (<.0001) |

| Decompression procedures for spinal stenosis | 0.967 (0.026) | –1.2 | 1.076 (<.0001) | 0.793 (<.0001) | 1.094 (<.0001) |

| Overall use of fusion procedures | 1.346 (<.0001) | 10.5 | 1.156 (<.0001) | 1.231 (<.0001) | 1.126 (<.0001) |

| Decompression and fusion procedures | 1.049 (0.203) | 1.6 | 1.116 (<.0001) | 1.076 (0.040) | 1.314 (<.0001) |

| Total orthopaedic procedures | 0.991 (0.0133) | –0.3 | 1.230 (<.0001) | 1.213 (<.0001) | 1.068 (<.0001) |

| Table 5: Age stratified effect estimates of health insurance status (odds ratios OR) and population attributable risks for major orthopaedic interventionsa. | ||||||

| Age 20–49 | Age 50–70 | Age >70 | ||||

| Intervention | OR | PAR% | OR | PAR% | OR | PAR% |

| Joint surgery | ||||||

| Total joint replacements | 0.830 (<.0001)b | –4.3 | 0.603 (<.0001) | –25.6 | 0.804 (<.0001) | –7.9 |

| Total hip arthroplasty (THA) | 0.771 (<.0001) | –5.9 | 0.611 (<.0001) | –24.9 | 0.803 (<.0001) | –8.0 |

| Total knee arthroplasty (TKA) | 1.020 (0.6433) | 0.5 | 0.593 (<.0001) | –26.4 | 0.806 (<.0001) | –7.8 |

| Total shoulder arthroplasty (TSA) | 1.908 (<.0166) | 18.0 | 0.614 (<.0001) | –24.7 | 0.883 (0.0868) | –4.6 |

| Surgery for hip fractures | 0.639 (0.0016) | –9.6 | 0.403 (<.0001) | –44.2 | 0.630 (<.0001) | –16.1 |

| Knee arthroscopy (KA) | 2.166 (<.0001) | 22.0 | 0.982 (0.7086) | –0.9 | 1.059 (0.0064) | 2.2 |

| Shoulder arthroscopy (SA) | 1.299 (<.0001) | 6.8 | 0.828 (<.0001) | –9.7 | 0.988 (0.8579) | –0.4 |

| Spinal surgery | ||||||

| Spinal surgery (decompression or fusion) | 0.807 (<.0001) | –4.9 | 0.822 (<.0001) | –10.0 | 1.261 (<.0001) | 8.9 |

| Decompression procedures for spinal stenosis | 0.757 (<.0001) | –6.3 | 0.739 (<.0001) | –15.5 | 1.163 (<.0001) | 5.8 |

| Overall use of fusion procedures | 0.932 (0.1334) | –1.7 | 0.969 (0.4205) | –1.6 | 1.491 (<.0001) | 5.5 |

| Decompression and fusion procedures | 0.774 (0.0004) | –5.8 | 0.741 (<.0001) | –15.3 | 1.099 (0.2177) | 3.6 |

| Total orthopaedic procedures | 1.330 (<.0001) | 7.4 | 0.752 (<.0001) | –15.3 | 0.818 (<.0001) | –7.3 |

| a Five-year age groups, gender and year of surgery were included in all models but estimates are omitted from the table for reasons of comprehensibility b p-values in brackets | ||||||

Prior research has documented wide variation in hospitalisations for musculoskeletal conditions in Switzerland, but has left unanswered questions about the potential sources of unwarranted variation [1]. This study shows that the level of health insurance accounts to some extent for variation in this context, but the results are only partially consistent with the hypothesis that volume of services increases with comprehensiveness of cover [16–18].

In 2005, 9% of total Swiss health expenditures were financed by supplementary health insurance, 32.7% by mandatory basic health insurance, 31.6% by private households and the remainder by other forms of insurance cover (accident, invalidity, armed forces) and by cantonal or federal subsidies [19]. The decreasing populations of persons with supplementary cover between 2002–2005 probably arises from the fact that premiums of basic health insurance have been rising significantly faster than the overall economy or personal incomes in recent years. This is squeezing household budgets and leaves less money to spend on supplementary coverage. Furthermore, in the view of many individuals mandatory cover includes all the necessary treatments [20]. The decrease may also reflect the effect of demographic change towards ageing and multimorbid populations and health insurers reluctant to sell additional cover to such high risk populations.

The overall odds ratio for insurance type points to a significant but only a small effect on the probability of surgery between the two insurance classes. However, there is considerable variation in risk ratios and attributable fractions across types of surgery and age groups. These differences may not only be related to varying needs for surgery between populations, but may also point to structural factors of care and are also in line with earlier research emphasising the effect of financial incentives [18]. However, our study cannot provide evidence of causal relationships, and additional research is needed to confirm the assumptions that follow.

The data of the 2007 Swiss health survey [12] show that supplementary health insurance is typically purchased by high income populations [7], also characterised by higher education, better self-perceived health status, fewer work-related musculoskeletal problems, a healthier lifestyle and usually high health insurance deductibles. All these characteristics may contribute to an overall lower use of joint surgery and hip fracture repair, irrespective of age, and of spinal surgery in younger age groups in the population with supplementary cover. The respective attributable fractions suggest that these preventive characteristics and behaviours have a considerable potential for cost savings.

Explanations for a higher incidence of surgery in the population with supplementary cover for spinal surgery in the age group above 70, and arthroscopy for patients aged 20–49, may be rooted in organisational aspects of care, and some important issues should be noted in this context. All medical services listed in the basic benefit package are reimbursed by basic health insurance irrespective of supplementary cover. Higher levels of remuneration for services not directly related to the treatment of musculoskeletal disorders may encourage physicians and hospitals to increase the number of surgical interventions provided for patients with supplementary cover, and oversupply at the expense of basic health insurance is the consequence. These patterns not only increase the direct costs of care but also affect equitable access to care in situations where physicians treat patients covered by either form of insurance; a diversion of resources from the public to the private sector may occur.

It can be argued that the observed expansion of hospitalisations in the population with supplementary insurance, which covers only luxury and amenity services, may be of no concern in relation to over-use of resources, as only a few age groups are affected. However, spinal surgery in ageing populations in particular is expensive, and the observed expansion of volume can add significantly to the overall cost of Swiss healthcare.

The comparably high incidence of arthroscopies in the group with supplementary insurance is likely to be based on similar mechanisms, but particular differences in treatment modes between insurance classes should be noted. Most arthroscopies in Swiss hospitals are performed in an ambulatory setting and are therefore not visible in our data, which include only inpatient interventions. Patients with supplementary insurance are often hospitalised for at least one night after arthroscopy and the observed high odds ratios are most likely the result of selection bias. With respect to the continuing rise in healthcare expenditures and the current political debate on its reasons, it may nevertheless be advisable to examine the substitution between ambulatory and inpatient care. Arthroscopy could be a natural candidate to analyse to what extent the observed higher incidence of inpatient treatments is due to selection effects, and to identify potential determinants (e.g., different remuneration) of outcomes and costs. Such an approach would require comprehensive data on arthroscopies performed in the out-patient setting, which are not currently available.

In some countries private health insurance can enhance access to care, and waiting time for elective surgery, e.g. for joint replacements, can be shortened [7]. Age statistics at surgery of our study provide no evidence of non-equitable access to elective surgery (i.e. joint replacements) as a function of insurance status, assuming that effective needs are equal. But inverse age structure of patients for spinal surgery and for hip fracture repair between insurance classes is of concern. Different levels of work-related physical activity can provide an explanation of younger age at surgery for spinal problems in the group with solely basic insurance. But the reason for older age at surgery for hip fractures in the same group remains a matter of speculation, as the aetiology of osteoporotic hip fractures is of a multifactor nature including life-style, nutrition, level of physical activity and extent of comorbid conditions [21].

It is possible that new medical technologies are more quickly incorporated into benefits packages of supplementary insurance and may thus lead to inequitable access for innovative treatments as insurers are allowed to make profits. Therefore, it may be rational for insurers to extend coverage to innovative treatments for individuals with supplementary health insurance. Differences in quality of care may be the consequence. However, insurers are reluctant to cover costly procedures and devices that have not demonstrated clinical effectiveness, as required by the Swiss health authorities for inclusion in the basic package. Wide variation in this context is therefore unlikely. But a factor that affects quality of care is morbidity, which may result in poorer outcomes and longer postoperative recovery. Inequalities to the disadvantage of the population with only basic health insurance, characterised by higher levels of comorbid conditions, are therefore possible because health insurers are avoiding contracts for additional cover with populations suffering from preexisting comorbid conditions. However, there are currently no Swiss data available that would formally support the notion of better medical quality of care for musculoskeletal disorders for populations with supplementary health insurance, and likewise, OECD data provide no evidence that additional insurance is promoting the delivery of a better quality of care [7].

The study is based on information concerning the health insurance status of 67% of the Swiss population, and selection bias cannot be excluded. However, comparison of our data with those of the Federal Office of Public Health showed reasonable concordance on the overall distribution of insurance classes. It is also unlikely that hospitalisations of populations covered by insurance companies not participating in this project differed substantially from the observed patterns, as decisions to hospitalise a patient may be influenced by type of coverage but not necessarily by the brand name of the respective company. Effects of socioeconomic status and cultural attributes of populations could not be analysed, as the respective data are not available at the level of utilisation-based health service areas, but we were able to use data of the Swiss health survey to explain some of our results. Misclassification in relation to insurance group, health status and resource use are possible in this context, as respondents may not have correctly answered the respective questions, but the available data and other information within the same domain provide no indication of the existence, direction and extent of selection and misclassification bias. Other limitations refer to the fact that information on the actual medical needs of populations is not available, and conclusions on inequitable access to care across insurance groups should be approached with caution. It would also be interesting to analyse data incorporating information on physicians and hospitals. This would allow a discrimination of effects between hospital-based and affiliated physicians and between private and public hospitals. It was not in the scope of this article to provide an in-depth analysis of regional differences in the use of orthopaedic surgery. However, the observed regional patterns underpin the need for further research in this domain.

The study provides empirical evidence that status of health insurance accounts for considerable variation in hospitalisations for musculoskeletal problems in Switzerland. There is evidence that supplementary health insurance – as a proxy for higher socio-economic status – is related to lower needs for surgery. There are no signs of major inequities in access to care across different forms of health insurance cover, but there are indications that resources for spinal surgery are diverted to the private sector at the expense of social health insurance. Lower use of healthcare resources in the population with supplementary cover shows that in Swiss healthcare use does not necessarily increase with comprehensiveness of cover. The preventive behaviour of this population may therefore be a subject for further research.

The study was supported by funding from the Swiss National Science Foundation (SNSF grant 405340-104607/2). The authors have no competing interests to declare.

1 Widmer M, Matter P, Staub L, Schoeni-Affolter F, Busato A. Regional variation in orthopedic surgery in Switzerland. Health Place. 2009;15(3):761–8.

2 Fisher ES, Wennberg DE, Stukel TA, Gottlieb DJ, Lucas FL, Pinder EL. The implications of regional variations in Medicare spending. Part 1: The content, quality, and accessibility of care. Ann Intern Med. 2003;138(4):273–87.

3 Hanchate AD, Zhang Y, Felson DT, Ash AS. Exploring the determinants of racial and ethnic disparities in total knee arthroplasty: health insurance, income, and assets. Med Care. 2008;46(5):481–8.

4 Deyo RA, Mirza SK. Trends and variations in the use of spine surgery. Clin Orthop Relat Res. 2006;443:139–46.

5 http://www.vesalius.com

6 Colombo F. Towards more choice in social protection? Individual choice of insurers in basic mandatory health insurance in Switzerland. In Labour market and social policy – occasional papers No 53 Paris, France: OECD; 2001.

7 OECD: Private Health Insurance in OECD Countries. In The OECD Health Project. OECD; 2004.

8 van Doorslaer E, Masseria C, Koolman X. Inequalities in access to medical care by income in developed countries. CMAJ. 2006;174(2):177–83.

9 Klauss G, Staub L, Widmer M, Busato A. Hospital service areas – a new tool for health care planning in Switzerland. BMC Health Serv Res. 2005;5(1):33.

10 SFOPH: Statistik der obligatorischen Krankenversicherung 2006. Swiss Federal Office of Public Health; 2006.

11 Charlson ME, Pompei P, Ales KL, MacKenzie CR. A new method of classifying prognostic comorbidity in longitudinal studies: development and validation. J Chronic Dis. 1987;40(5):373–83.

12 BFS: Schweizerische Gesundheitsbefragung 2007: Erste Ergebnisse. Swiss Federal Statistical Office; 2008.

13 Matter-Walstra K, Widmer M, Busato A. Analysis of patient flows for orthopedic procedures using small area analysis in Switzerland. BMC Health Serv Res. 2006;6:119.

14 Kleinbaum D, Kupper L, H M. Epidemiologic Research: Principles and Quantitative Methods. New York: Van Nostrand Reinhold Company, Inc.; 1982.

15 BFS: Standardtabellen – Interaktive Applikation auf CD-ROM. Swiss Federal Statistical Office; 2009.

16 Manning WG, Newhouse J, Naihua D, Keeler E, Benjamin B, Leibowitz A, S M, Zwanziger J. Health Insurance and the Demand for Medical Care. In Health Insurance Experiment Series Santa Monica: The Rand Cooperation; 1998.

17 Holly A, Gardiol L, Domenighetti G, Bisig B. An econometric model of health care utilization and health insurance in Switzerland. European Economic Review. 1998;42(3-5):513–22.

18 Domenighetti G, Casabianca A. Rate of hysterectomy is lower among female doctors and lawyers' wives. BMJ. 1997;314(7091):1417.

19 OECD/WHO: OECD and WHO survey of Switzerland’s health system. Paris, France: Organisation for Economic Co-operation and Development 2006.

20 Eisler R, Lüber A. Wie wichtig ist den Schweizern eine Spitalzusatzversicherung? Resultate einer repräsentativen Studie von comparis.ch in Zusammenarbeit mit dem Marktforschungsinstitut Demoscope. Zürich: Comparis.ch; 2006.

21 WHO: Prevention and Management of Osteoporosis. In WHO Technical Report Series, No 921. Geneva: WHO; 2003.